A recent workshop with Robin Pew, the Chief Economist and Editorial Director from The Economist Intelligence Unit set out the megatrends to watch out for.

Trend #1 Debt

Today, the world is seeing both the greatest transfer of wealth and debt between generations than it has ever known before. Future generations are expected to continue to build enormous debts that will pass on from their generation to the next. Insufficient provision has been made in the public sector globally to manage levels of debt, and in our last decade here in the UK, ambitious promises were made with the public purse that were never going to be able to be funded.

The inability to meet these promises has not only left a nation disgruntled, but tax revenues will continue to fall short. The position will worsen as the population ages and birth rates slow down. Less people paying tax means less tax will be collected to support services and this means citizens will be financially squeezed through ‘stealth’ taxes in other ways. The demise of the Euro, will see everything from ATM machines disappear to free travel slowing down. According to the Economist, the UK can’t afford for the Eurozone to fail-the consequences will be enormous.

Trend #2 Emerging Markets

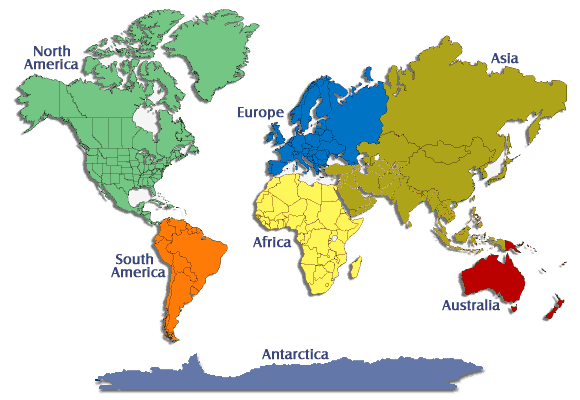

In 2020, China will be the world’s largest economy. The emerging markets to watch are Brazil, India, Colombia, Indonesia, Egypt, Vietnam, South Africa, Nigeria, Thailand, and Saudi Arabia all of whom are growing faster than traditional economies. Demographics are important to note: the average age of a person in India is 24 years old, therefore the ability to grow, support and sustain that economy is forecasted to be better than those economies that have a heavier proportion of more elderly people. China is now worried having enforced a one -child policy, they can now see that this will cause issues with their own growth plans. In the old Russia, Aids and Alcohol continue to shrink the population. The US, Japan and German economies will over time, begin to pale in comparison, although at the moment, the G7 economies are still significantly bigger than all of the emerging economies put together.

Trend #3 Greening

It is easy to ignore the ‘green agenda’ but the fact remains that regulation is increasing and as China moves 60million people out of agricultural work into factory work and more urban centred work, the demand for raw materials will increase disproportionately. In 2020 another 1bn consumers are expected to put even more pressure on commodity prices – price will be the key. Over the past 170 years commodity prices have grown five fold. The message is important, the demand for raw materials and the prices for those raw materials, along with population shifts in emerging markets will put extraordinary pressure on the environment to produce what is needed to support the world-there are likely to be shortfalls and this means significant price increases for basic commodities.

Trend #4 Ageing

Across the planet, the average age of a human being is 29 years old. In 2050, the average age will be 38. There largest growth in population will be seen in the emerging markets. China will be old before it is ‘rich’, with the population being ‘much poorer’, despite the fact that it will be the biggest economy. Our average income is coming up to 40K(USD). In the USA, it is 140K (USD).

There will be 6x more people over the age of 85 and this in turns creates the need for more healthcare. In advance of this, Singapore is setting itself up in healthcare tourism. International migration is increasing as the search for quality healthcare continues.

The leader in ageing is Japan, which has the largest number of people over 100. They are adapting their products and services to reflect their older population. The example given was around baby nappies, which of course traditionally were used for babies. However, the market for baby nappies is declining because birth rates in Japan are low. The nappy manufacturers have turned to producing nappies for pets because as the population ages, the ability to get out and exercise a pet decreases. The Japanese see nappies for pets as a way to keep a pet when age/disability prohibits exercising the pet.

Trend #5 Global Swarming and Urbanisation

In 2006, a quiet trend reversed- we are now seeing more people opting to live in cities than in the countryside. Urban populations have expanded three fold since 1960. In 1970 the average family unit was 6 people; in 2012 it is 3.

In 2025 15 cities will have populations of more than 25m each – that level of population is larger than many countries. This city level opportunity is greater than opportunities in some countries. 200 cities will have more than 1M people in 2020. 170 new mass transit systems will be built. 40bn square feet of new housing will be built.

Trend #6 Globalisation

Up until now, there were three phases to globalisation:

- Exports

- Manufacturing capacity moved overseas to manufacture goods to be returned to the home country

- Manufacturing capacity which had been moved overseas, now manufacturing goods for return to home country and in the country of manufacture

We are now entering a fourth stage:

- Emerging markets looking to do business overseas.

Examples given were car companies that have moved into the ‘west’ either through partnering or packaging and marketing e.g. the Japanese car manufacturing market into the US. The message is to take a very close look indeed at what emerging markets are going to market with; what their ambitions are; what IP they have and partner with them.

Summary: Hyper globalisation is here and East is winning financially. Ageing populations offer opportunities but will also cause issues around government ability to support their citizens.

marketingmoves. Only the best marketers. Only for IT and Telecoms. www.marketingmoves.com or 01932 253352.